Bitcoin Price (BTC)

BTC/USDT

28,979.99

≈$28,963.90

-1.64%

BTC/USDT

28,979.99

≈$28,963.90

-1.64%

ETH/USDT

1,829.9

≈$1,828.88

-2.25%

DFT/USDT

0.015025

≈$0.01

-1.96%

HOPPY/USDT

0.0000000029

≈$0.00

-20.55%

NOVA/USDT

0.00000000619

≈$0.00

+12.24%

The project name is X with Contract Address:

https://etherscan.io/token/0xa62894d5196bc44e4c3978400ad07e7b30352372.

CCA coin is commodity circulation accelerating

DeFi platform, which was released in October 2020,

based on the technique of 3rd generation PoS 3.0

block chain. The following Block chain connects

without a middleman or bank through ‘Smart

contract’ of AOK main-net between subjects who

trade commodity circulation. The block chain makes

reliable trade by ensuring fairness, clarity and

credibility on circulation allowance occurred in

the process between the couple of parties. The

participant can invest and also join in donation

at the same time Through automatically

accumulating the part of interest of participants'

deposit coin as a donation. Through the system

platform provide the benefit to the participant

and also contribute to viability of sustainable

enterprise by ensuring clarity and financial

solvency.

BCH 3 times Short (BCH3S) is a tradable product

that tracks three times the daily profit of

Bitcoin Cash. Users shall pay attention to the gap

between the actual net val

LRC 3 times Short (LRC3S) is a tradable product

that tracks three times the daily profit of

Loopring. Users shall pay attention to the gap

between the actual net value.

SOL 3 times Short (SOL3S) is a tradable product

that tracks three times the daily profit of

Solana. Users shall pay attention to the gap

between the actual net val

IOTX 3 times Short (IOTX3S) is a tradable product

that tracks three times the daily profit of IoTeX.

Users shall pay attention to the gap between the

actual net value.

FTM 3 times Short (FTM3S) is a tradable product

that tracks three times the daily profit of

Fantom. Users shall pay attention to the gap

between the actual net val

ALICE 3 times Short (ALICE3S) is a tradable

product that tracks three times the daily profit

of MyNeighborAlice. Users shall pay attention to

the gap between the actual net value.

ONE 3 times Short (ONE3S) is a tradable product

that tracks three times the daily profit of

Harmony. Users shall pay attention to the gap

between the actual net value.

Pocketcoin (PKOIN) is a Proof-of-Stake token that

allows authors to earn crypto for their content

and protects them from arbitrary censorship

through community moderation. Blockchain tracks

reputation and high reputation users moderate the

platform. PKOIN is for decentralized advertising,

boosting posts, buying unique fonts and themes in

Pocketnet, as well as auctioning off NFT-Scarce

tokens in the upcoming releases. Pocketnet is a

network of fully decentralized equal nodes ran by

users (hundreds of nodes around the world are

already in operation.

Japan’s National Tax Agency recently amended certain interpretations of the Corporate Tax Law. Cryptocurrency issuers in Japan will no longer need to pay a 30% corporate tax on unrealized cryptocurrency profits. Let’s take a deeper look at the recent changes. Amendment of Cryptocurrency Tax Laws Under the previous regulations in Japan, cryptocurrency issuers had to pay a 30% corporate tax on the tokens they held, even if they hadn’t profited from selling them. This provision was long criticized for being a “burden to businesses and hindering innovation in the virtual currency and blockchain industry”, leading some businesses to operate overseas. However, Japanese lawmakers have been discussing new cryptocurrency tax rules since August last year. In December, the Liberal Democratic Party approved a proposal that, starting from April 2023, can relax the taxation rules for virtual currency-related businesses, and this provision was finally implemented this week. This legal revision will be included in the 5th fiscal year of the Reiwa era “Governing Party Tax Reform Charter” as part of the broader tax reform of 2023. It’s worth noting, according to CoinPost, the amendment only applies to tokens issued by the “issuer’s company”. Capital gains tax still applies to tokens issued by “other companies”. (Image via Wikipedia) Ban on Stablecoin Issuance by Non-Banking Institutions In June last year, the Japanese government passed a bill prohibiting non-banking institutions from issuing stablecoins. This law came into effect on June 1 this year, stating that stablecoin issuers must have licenses, be registered agent banks, trust companies, etc. In a recent announcement, Japan’s largest bank, MUFG, announced it is in talks with several overseas stablecoin issuers to use its stablecoin issuance platform “Progmat Coin” on public chains such as Ethereum, Polygon, Avalanche, and Cosmos to launch stablecoins pegged to yen and foreign currencies. (Image via PR TIMES) Stricter Anti-Money Laundering Measures According to Kyodo News, Japanese lawmakers decided to implement stricter anti-money laundering (AML) measures from June 1, including the Travel Rule to track cryptocurrency transactions and combat money laundering and other criminal activities. The Travel Rule requires financial institutions processing crypto asset transfers to send customer information to the next institution while handling cryptocurrency transactions. This information includes the names and addresses of the sender and receiver. The mentioned crypto assets include stablecoins or cryptocurrencies pegged to the US dollar, commodities, etc. Those who disobey the AML measures will face criminal penalties. Keywords: Japan, Cryptocurrency, Corporate Tax, National Tax Agency, Corporate Tax Law, Unrealized Profits, Liberal Democratic Party, CoinPost, Stablecoin, Non-Banking Institutions, MUFG, Progmat Coin, Ethereum, Polygon, Avalanche, Cosmos, Anti-Money Laundering, Travel Rule, Kyodo News

The Birth and Legal Battle of MetaBirkins NFT In December 2021, American artist Mason Rothschild released a series of NFTs dubbed “MetaBirkins”, inspired by Hermès’ classic Birkin bag. Less than a month later, Hermès accused Rothschild of copyright infringement. The lawsuit was settled in February, resulting in a victory for Hermès. Recently, a federal judge in Manhattan issued an order permanently banning Rothschild from selling the contentious MetaBirkins NFTs. (Image via THE IMPRESSION) Rothschild – A Fraudster, Says the Judge Manhattan Federal Judge Jed Rakoff stated in the document, “In fact, the jury found that Rothschild was a fraudster. Hermès proved that Rothschild deliberately misled consumers, making them believe that Hermès was endorsing its product.” Compensation and The Impact of the Verdict Hermès will receive a compensation of $133,000. The latest judgment determined that the NFT series launched by Rothschild is not protected by freedom of speech. The judge’s order last Friday also imposed permanent restrictions on Rothschild in many ways, significantly limiting the future use of MetaBirkins. Restrictions on Marketing and Promotion The judge’s order prohibits Rothschild and his associates from marketing, selling, and minting MetaBirkins NFTs. It also prohibits Rothschild from making future statements that might lead people to believe that MetaBirkins is associated with Hermès. Airdropping the Order and Intellectual Property Protection Interestingly, the judge has asked Rothschild to “airdrop” Friday’s order to existing MetaBirkins token holders. The lawsuit filed by Hermès against Rothschild highlights the challenge of how brands protect their intellectual property rights in the NFT space. Infringement Charges and Defense In February of this year, the court found Rothschild guilty of trademark infringement, trademark dilution, and cybersquatting. Despite Rothschild’s defense in the name of art, the jury found that Rothschild intentionally misled consumers into believing that Hermès supported the project. (Image via The New York Times) Post-Trial Actions and Claims After winning the lawsuit, Hermès claimed that Rothschild “continues to promote the sale of MetaBirkins NFTs on social media and sales platforms, while seeking royalties for these sales.” Hermès has demanded that Rothschild transfer any remaining MetaBirkins NFTs he holds to a wallet designated by Hermès, and give up control of the Ethereum smart contract for the collection series. Domain Name Transference and Freedom of Speech However, Judge Jed Rakoff did not side with Hermès on this issue, arguing that “MetaBirkins NFT is art, at least in some respects”. He stated that the necessity of the injunction comes from a high degree of caution towards freedom of speech. Rothschild has been ordered to surrender any domain names related to the Hermès Birkin bag trademark, including “metabirkins.com”, although he can retain ownership of the MetaBirkins NFT. Rothschild has been ordered to transfer the domain names by July 15, after which Hermès will archive these domain names. Keywords: Hermès, Mason Rothschild, MetaBirkins, NFT, Birkin Bag, Infringement, Intellectual Property Rights, Freedom of Speech, Trademark, Cybersquatting, Ethereum Smart Contract, Domain Name

Fed’s Balance Sheet Dropped to Pre-Silicon Valley Bank Collapse Level In March this year, a series of shockwaves from banks such as Silicon Valley Bank triggered the Fed’s emergency relief tool – the “Bank Term Lending Scheme”. This scheme led to a rapid increase in the Federal Reserve’s balance sheet by about $300 billion in a week, reaching a peak of about $8.733 trillion as of March 21. However, according to the Fed’s latest data, since March 21, the Fed has indeed continued to shrink its balance sheet. As of June 20, the scale of its balance sheet has dropped to $8.362 trillion, approaching the scale of $8.339 trillion before the collapse of Silicon Valley Bank. (Image via Fed) Pause in Rate Hikes, Market Anticipates Rate Cuts After ten consecutive rate hikes, the Federal Reserve recently paused for the first time, maintaining the benchmark interest rate at 5%-5.25%. However, the FOMC’s dot plot suggests that the median expectation for the final interest rate for 2023 is 5.6%, which means at least two more rate hikes might occur. But, Jerome Powell, Chairman of the Fed, emphasized last week that this pause does not mean they will not continue to raise interest rates. (Image via investopedia) Moody’s Forecast: The Fed May Cut Rates Next March In its latest report, Moody’s Analytics believes that the current interest rate level is already high enough to bring inflation down to the Fed’s target. However, Powell’s testimony in Congress last week suggested that this pause in rate hikes might be more of a “skip” in hikes, with further hikes possible in the second half of the year. Moody’s predicts that the Fed will start cutting rates in March 2024, as the persistence of inflation has exceeded expectations. (Image via Reuters) Keywords: Moody’s Analytics, Federal Reserve, Silicon Valley Bank, Balance Sheet, Rate Cut, Rate Hike, Powell, Inflation, Fed, FOMC

Terra blockchain founder, Do Kwon, has found himself in a legal predicament. Recently, Swiss authorities seized assets totaling $26 million – double the initially estimated amount. Kwon, along with his assistant Han Chang-joon, was arrested in March for attempting to leave the country with fake passports. Arrested for Document Fraud Kwon and Chang-joon were arrested in Montenegro (the Republic of Montenegro) earlier this year. According to the Montenegrin court’s announcement, both were found guilty of ‘forgery of documents’ and were sentenced to four months in prison. The court is currently considering South Korea’s extradition request, but no decision has been reached. $26 Million Frozen in Switzerland In addition to the legal troubles in Montenegro, the Swiss prosecutor’s office has recently frozen Kwon’s assets stored in Signum, a digital asset bank in Zurich, Switzerland, according to a weekend report by South Korean media, “Digital Asset.” The frozen assets amount to $26 million. (Image via The Times of Israel) The reported account belongs to Do Kwon, former TFL CFO Han Chong-Joon, former head of the TFL research team Nicholas Platias, and TFL Company. Some of the assets are in Bitcoin. Interestingly, the frozen assets are double the amount initially estimated by Korean prosecutors. Earlier this month, the head of the financial securities crime department of the Seoul District Prosecutor’s Office revealed in an interview that “funds related to Do Kwon exceed $13 million.” Is there More Hidden Assets? According to BlockTempo’s report in February, the U.S. Securities and Exchange Commission (SEC) stated that Do Kwon and Terra’s parent company, Terraform Labs, had previously stored over 10,000 Bitcoins in a cold wallet. Since the Terra USD crash in May 2022, Bitcoin from the cold wallet was periodically transferred to a bank in Switzerland and converted into cash, allegedly cashing out $100 million. Furthermore, a statement by South Korean prosecutors in April estimated the total amount of illegal assets related to Terra to be about $314.2 million. Of these, the illegal income related to Do Kwon was $69 million. However, he left almost no assets in South Korea, leading to public speculation about whether Do Kwon has other hidden assets elsewhere. Keywords: Do Kwon, Terra, Montenegro, Document Forgery, Swiss prosecutor’s office, Digital Asset, Signum, Nicholas Platias, TFL Company, Seoul District Prosecutor’s Office, Blockzone, Terraform Labs

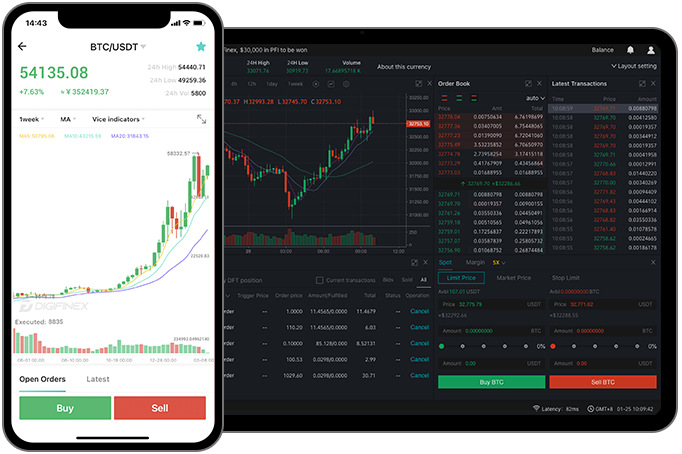

Scan to download

Start trading in just 2 minutes!

请输入需要翻译的文本。